Part 1: Changes in the business environment

The coronavirus has raised many new and critical problems for businesses of all size – operational and strategic problems. Most of my comments today will focus on operational issues.

Optical cable assemblies are components in communication networks, data centers, medical equipment, and other systems. As such, cable assemblies are like raw materials – closer to the bottom of the supply chain. The finished networks or systems are near the top, with the end-user services at the top.

In this position, assembly makers benefit from growth in end-use applications, but they can’t drive that growth. The assembly market’s growth depends on upward trends in network construction and utilization, or in the sales of other system-level products. In this situation, assembly company managers focus carefully on production costs in order to address requirements of profitability, market acceptance, and competitiveness.

Now, the covid-19 pandemic has brought new issues affecting the production side of the equation. In short, worker safety has taken a prominent role in operations. To better support optical cable assembly manufacturers, FOC has reviewed many on-line documents with guidelines for businesses, especially manufacturing operations.

Two federal agencies have documents with guidelines: the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA). In addition to the state guidelines, the various states have recommendations, usually on websites run by the department of health, a business-administration agency, or a special purpose covid-19 task force.

The CDC and OSHA offer general guidelines and also refer business owners to their state authorities. FOC’s data indicates that 32 of the 50 states have at least one optical cable assembly production facility, and 10 states have more than 10 factories. The level of detail varies among the different states’ covid-19 recommendations.

Some states offer detailed documents resources, running 10 pages or more. There are also resources such as recommendations for training and templates for workplace posters, signs, and floor markings. California and New York are among the states with the most detailed documents. (California and New York also have the most assembly factories among the states.)

A common element of all these guidelines, and a first step for the managers, can be summed up in three words: ‘have a plan.’ Or perhaps in some cases, ‘have multiple plans,’ including plans for safety, training, emergency response, etc. Other common elements are listed below:

Common elements in state guidelines for manufacturing

- Spacing and occupancy

- Multiple shifts to lower simultaneous occupancy

- New workflow procedures when necessary

- Minimize meeting, gatherings, visitors

- Regular cleaning procedures

- Masks

- Assessment protocols

- Taking temperature

- Employees answer health questions

- Stay home if sick

- Protocols in case of a positive test

- Track employee contacts

- Deep cleaning procedures

- Close/re-open guidelines

- Available of supplies for PPE, temperature, cleaning, disinfecting, etc

- Training employees (cleaning, distancing guidelines, work procedures, etc.)

State guidelines and implementing new safety procedures

As part of our practice to provide consulting and training for assembly manufacturers, FOC can assist with questions about complying with state guidelines and implementing new safety procedures. Like many companies, we have shifted as many employees as possible to working from home. We also are using technology to develop new methods of training and support that incorporate videos, thus effectively shifting some of the hands-on training to over-the-web training.

As travel restrictions are being lifted, we have adopted “best practice” guidelines for documentation and log-in procedures. These documents can be used with visitors or modified to be used for internal procedures. Please contact us if you wish to take advantage of training and consulting sessions using videos, or in-person training, or sample documents for logging-in visitors. Also, I have described FOC’s approach to managing remote and in-house workers during the pandemic in Part II of this series.)

As circumstances evolve, I am also focused on the evolution of our employees’ safety, stress and engagement. All leaders are refining their systems and approach during this current phase of the crisis. Employee focused leadership is a foundational requirement for reinventing work systems, productivity and efficiency.

FOC operates by our core values with daily focus on our employees and their remote location experiences. In addition to evaluating and maintaining awareness of the current crisis and developing new corporate systems and procedures, as outlined above, we follow a checklist of the four C’s to provide to employees: Clarity, Communication, Connection and Consideration. Please read about our dedication to employee focused leadership in my blog, The CEO role during a global crisis.

On the strategic side

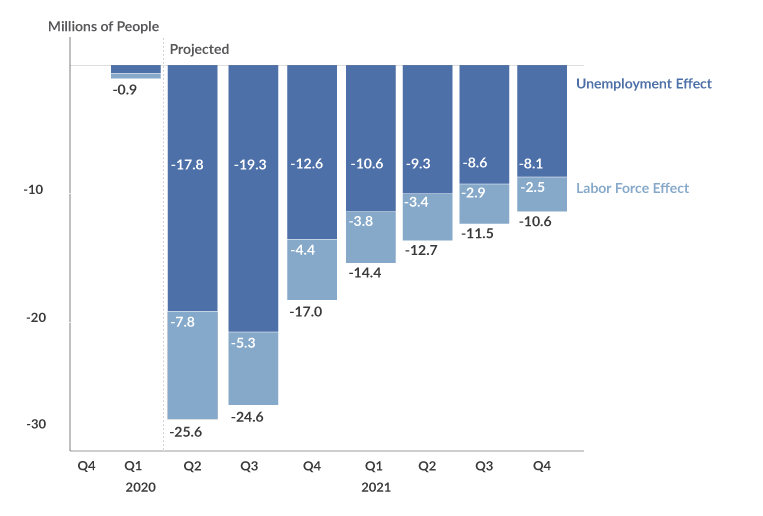

When I commented on business-planning considerations in early April, I said it was early days and we’d need more data to develop one-year projections and revised plans. Now, we have the data for unemployment and other indicators after the month of April. In the US, about 27 million people or 17% of the workforce have filed unemployment claims. Purchasing managers’ index data for April showed the sharpest downturn since 2009. (https://www.dol.gov/ui/data.pdf)

So the severity of the recession is not in question. In April’s comment, I noted that businesses associated with information and communications technologies would fare better than companies in other industries. Recently released financial results of telecom and data-center businesses are supporting this view. The main issue to confront in long-term planning is how long the recession will last or what “shape” the recovery will have.

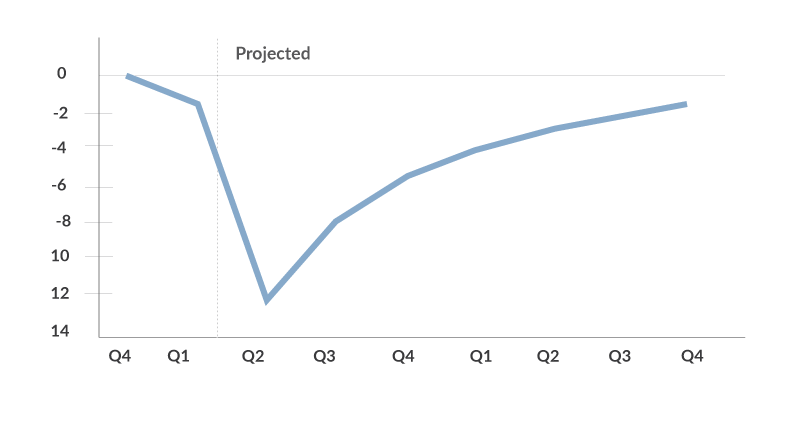

For this, we again have to say, it’s early days to get a good picture of the recovery. There are as many forecasts as there are forecasters. The optimistic view has the recovery starting in H2 this year and progressing through 2021. The steepness of the recovery in 2021 varies, but here is one view from the US government’s Congressional Budget Office May 2020 report (https://www.cbo.gov/publication/56368):

Output and Employment Measured as the Difference From the Fourth Quarter of 2019

Real Output

EMPLOYMENT

Any forecast about economic recovery, of course, will depend on public-health variables. Could there be a second surge of covid-19 cases? Will a vaccine become available in significant quantities to change the economy in 2021? Until we know more about these factors, it is important now to look at what we do know: there will be a recovery, with significant progress made in 2021. As the next few quarters roll-out, a key element for businesses of all sizes is to intensify the focus on worker safety and minimize any further health-related disruptions.

This article is an original publication of Fiber Optic Center, Inc. It is shared publicly for educational and reference purposes to support learning and professional development within the fiber optics industry.

You are welcome to read, cite, or reference this material for non-commercial and educational purposes, as long as full credit is given to Fiber Optic Center, Inc. and the author.

Reuse, reproduction, or adaptation of this content — including rewriting, republishing, or incorporating it into new materials (such as websites, blogs, marketing text, technical guides, or AI-generated content) — is not permitted without prior written consent from Fiber Optic Center, Inc.

This material is protected by copyright law upon publication, even if not formally registered.

Use of this content for AI training, automated data extraction, or derivative content generation is prohibited.

Fiber Optic Center monitors and enforces the integrity of its intellectual property through digital identifiers and content tracking.

For more details, please refer to the Fiber Optic Center Content Use and Copyright policy.